The Best ofIntima & Swim Edit

The Best of Intima presents its annual North American survey, based on interviews with 200 specialty stores nominated throughout the years for the Best of Intima Awards. The survey examines how these boutiques performed over the past 12 months and explores their outlook for the year ahead. Through our panel of interviewees, we analyze the United States and Canada separately to provide a more precise and insightful view of the market, including the brands that performed best in each country.

This study is essential to understanding the dynamics of the North American intimate apparel market, allowing us to identify top sell-out brands, track the evolution of styles across the continent, and gauge purchasing trends for the coming year. The survey also offers an opportunity to recognize and congratulate the brands that rank in the top spots for each product category, making them eligible to receive the Best Brand Awards plaque.

USA

With economic uncertainty and looming tariffs, retailers worked hard to navigate the challenges ahead. Nevertheless, shoppers prioritized investment-worthy, versatile pieces that offered both fit and comfort. Boutiques faced supply chain disruptions and higher customs duties, yet careful inventory management helped them maintain sales. Success continued to be driven by word of mouth, specialized expertise, and consistent product quality. Still, retailers reported frustration when brands modified or phased out top-selling products, potentially undermining customer loyalty and sales momentum.

Overview

If the majority of the stores (49%) registered a positive year, the number of those mentioning a decrease in sales increased by a significant 6 points in 2025. While 21% of our store panel anticipated finishing the year on par with 2024, (slightly down from last year) the remaining 30% projected a decline in sales, highlighting that overall, 2025 underperformed compared to the previous year. Notably, no stores reported experiencing a very poor year (- 30% or more).

Economic and political factors, including tariffs and general instability, frequently tempered demand. Overall, a combination of seasonal advantages, strategic business decisions, and active customer engagement shaped store performance throughout the year, even as results fell short of 2024.

What sold best

BRAS continue to dominate U.S. lingerie stores, leading the charts at 95%, a 10-point increase from the year before. The next closest contender, LINGERIE SETS, follows at 26%, marking a notable and significant 22% drop from the previous year. The rise in bra-only purchases and the decline in lingerie sets reflect shifting priorities in 2025; while still favoring fit and comfort, the higher cost of complete sets likely discouraged full purchases, with customers prioritizing bras as standalone pieces. NIGHT/LOUNGEWEAR held steady in third place at 21%, though many retailers cited it as the second most underperforming category overall. SPORTS BRAS remained fourth despite suffering a steep loss from 31% to 18%. SWIM/BEACHWEAR was also frequently noted for its disappointing sales (from 22% last year to 15%). SEXY LINGERIE fell from 29% to 14%, marking its second consecutive year of decline. DAYWEAR and BODYSUITS (both 9%) were followed by READY-TO-WEAR. ACCESSORIES and LEGWEAR (both 3%), while MENSWEAR was again last. Overall, the best-performing categories, such as comfort-driven bras, core lingerie, and everyday essentials, highlight a clear consumer shift toward functional, reliable pieces.

Customers’ main priorities

In 2025, FIT (85%) and COMFORT (82%) were again the two major customer priorities, although it was FIT this year that marked the top priority. PRICE rose to third place at 37%, surpassing FASHION (33%), reflecting shoppers’ heightened sensitivity to costs in an unsteady economy impacted by rising prices. MATERIALS, DURABILITY and WELL-FINISHED kept their positions, affected by just a slight decline, as did HEALTH/WELLBEING, MADE IN, and SUSTAINABILITY.

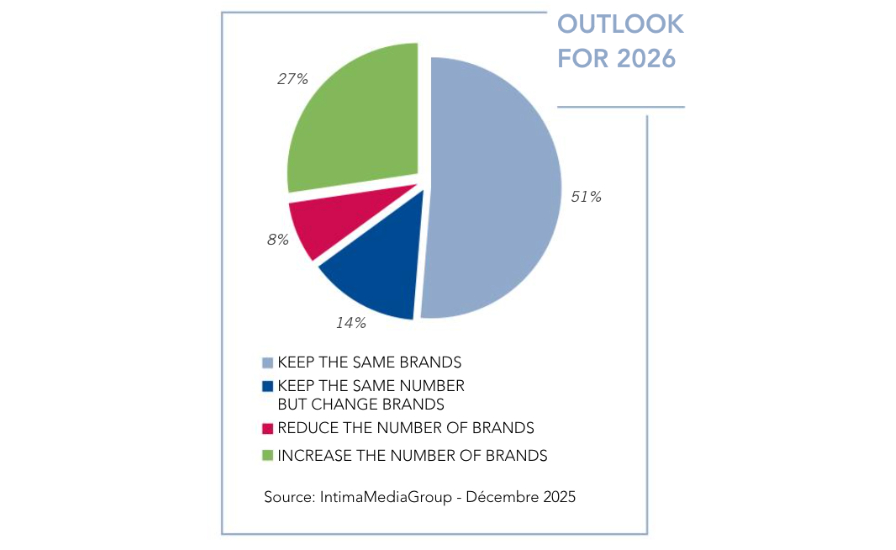

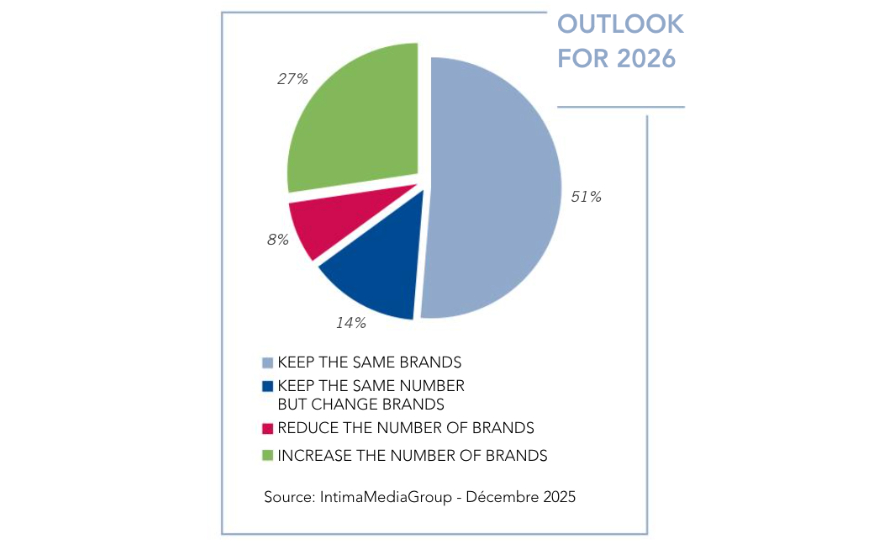

2026 Perspective

The percentage of brands on our panel who have decided to keep the same brands for the coming year has risen to 51% (from 45% last year). A slight rise can also be noted in the boutiques which will be increasing the number of brands, from 24% last year to 27% this year. 14% will be keeping the same number but changing brands (down from 18%) and 8% intend to reduce the number of brands (down from 14%).

CANADA

Our survey revealed that despite the growing financial uncertainties of the last years and the difficulty of tariffs with the US something shifted in 2025: a lingerie and intimate apparel sales were on the increase compared to the previous years. Understandably, Canadian consumers have been prompted to be more deliberate in their purchases, favoring longevity, practicality as well as paying attention to where products are made. While high-end boutiques remain devoted to European quality and craftsmanship a growing interest in Canadian labels was reported.

Overview

Despite the country’s difficult situation due to political and economic factors over the past two years, a ray of sun shone for stores in 2025 with sales closing on a positive note for 54% of the panel, marking an 11 point improvement over the previous year. While 27% reported results on par with 2024, only 19% saw declines, (with no store registering losses 20% +) a notable improvement compared to the overall 36% who saw decreases the year prior. Spring and summer remained the strongest periods (swimwear results were surprising), and many retailers attributed their stability to stronger marketing, thoughtful brand curation, and robust client relationships.

What sold best

The BRAS category dominated the Canadian market in 2025 at 90%, a 5% increase from the previous year. On the other hand, in line with US results, LINGERIE SETS, plunged from 80% in 2024 to just 20% in 2025, a striking decline; surprisingly this is lower than SWIM/BEACHWEAR which at 43% was only slightly down from 46% in 2024, as well as SPORTS BRAS steady at 33%, essentially unchanged from the year before. NIGHT/LOUNGEWEAR also experienced a meaningful downfall, from 28% to 17%. While part of this decline stems from the fading pandemic comfortwear trend, other factors contributed. Many consumers already stocked up on loungewear in previous years, economic pressures led shoppers to cut discretionary purchases, and fashion trends shifted toward versatile, multi-purpose clothing rather than dedicated night or lounge sets. Retailers in turn reduced floor space for loungewear in favor of higher-turnover essentials, reinforcing the decline. Other categories remained stable or declined modestly: SEXY LINGERIE and DAYWEAR (both13%), while READY-TO-WEAR remained at 10%. BODYSUITS declined from 13% to 7%, ACCESSORIES from 8% to 3%, and LEGWEAR from 5% to 1%, reflecting reduced impulse and trend-driven purchasing. MENSWEAR disappeared entirely at 0% as retailers shifted focus to higher-turnover women’s essentials.

Customer main priorities

In 2025, COMFORT (90%) only slightly down, again came first followed by FIT (71%) for the top spots, reflecting last year’s trend. PRICE remained in third place at 61%, however decreasing by 9 points from 2024, showing a customer willingness to invest in bras that provide reliable support and everyday wearability rather than focusing primarily on price. MADE IN increased by 16 points revealing customers are becoming increasingly attentive to this factor, as they are to DURABILITY and WELL FINISHED which also gained points. MATERIALS ranked a stable 24%, matching FASHION (which gained 9 points) while SUSTAINABILITY and HEALTH/WELL-BEING tied at 13%, only slightly up.

2026 Perspective

For 2026, 54% of our store panel plan to keep the same brands, (six points up from last year’s 48%), reflecting confidence in proven performers, also confirmed by the data that stores intending to reduce the number of brands fell by six points from 20% to 14%. The percentage of stores who plan to increase the number of brands remained stable and only 10% declared they are opting to keep the same number but to try changing brands.

Find all the BBA results in the latest issue of The Best of Intima magazine HERE.

Related articles:

Copyright 2026. All right reserved - Terms