The Best ofIntima & Swim Edit

Call to Action - How specialty stores are facing the situation

15 September 2020

The Best of Intima editorial team is in constant connection with independent boutiques to efficiently monitor their activity.

Traditionally focused on the summer selling season (What Sells Best Now), in light of this year’s events, this edition of the survey has been necessarily adjusted in order to monitor the emergency and provide a detailed overview of what the stores are going through during this global pandemic, how they are managing through this unprecedented time, and how they see their future in this new reality. Divided into two parts, the outbreak, back in the spring, and the ongoing COVID situation, up until the end of July, this survey collects the comments, feelings, and hopes of over 120 lingerie retailers in North America.

part 1- The Outbreak

FIRST STEPS

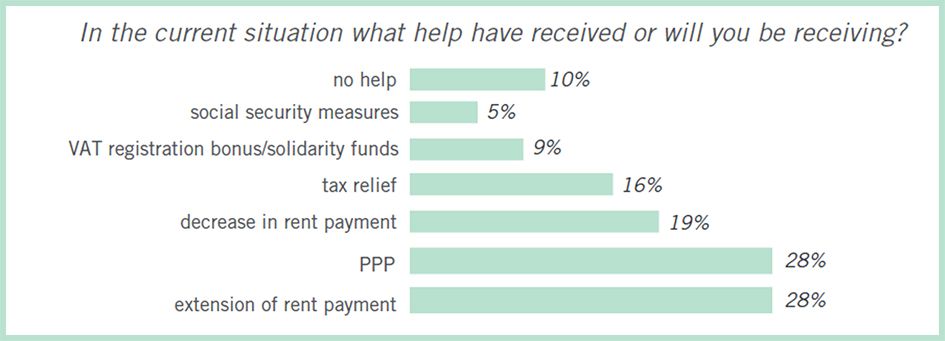

Almost as soon as the first closings were announced, the stores immediately pushed forward to try to contain their costs, minimize their losses, and obtain aid - aid which very often took a long time to arrive, due to the sometimes cumbersome and complicated procedures, endangering the financial balance and health of many retailers. Two aspects were abundantly clear from the first survey, first and foremost, storeowners were concerned and sought support for aid in paying their staff and their rent, and many took more than one course of action. In the USA, many boutiques applied for the Paycheck Protection Program Loan (“PPP”), a benefits program intended to provide a direct incentive for small businesses to keep their employees on the payroll; these accounted for 28% of respondents. As for Canada, many respondents noted that they were receiving the Canada Emergency Response Benefit (“CERB”) which gives financial support to employed and self-employed Canadians who have stopped working or work reduced hours due to COVID-19. Despite the various forms of government support, a few owners did sadly mention lay-offs While 19% indicated that they would be receiving a decrease in rent payment, 28% were otherwise receiving an extension of rent payment; nevertheless, many stores were faced with inflexible landlords, others had experienced pleasantly surprising support: “My landlord graced me with a phone call to let me know he did not expect full rent due to the government shut down,” reported a lucky store in the State of New York. Among the various responses, other various forms of support were encompassed, storeowners mentioned additional forms of support from the government (Economic Injury Disaster Loan, 2.5-year interest-free loans, wage subsidies), banks (mortgage or payment deferrals), or even crowdfunded through a Kiva loan. Important to note is that among the answers 10% had not yet received any kind of help.

Holding on to Something to Come Back to

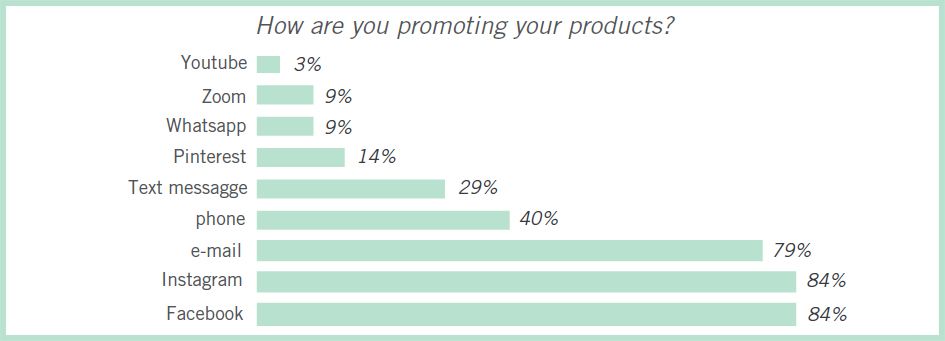

The store is closed, but business must forge on… but

where and how to sell if not in-store? Technology saves

the day. 100% of the stores were digitally active during

the lockdown, and have kept these goods habits since.

Let’s think about what we saw flooding our screens

during quarantine: people looking forward to their first

post-quarantine haircut, manicure, or otherwise trip to

the spa. Work-from-home looks, Mental Health

Awareness month, changes in diet, and exercise

challenges to keep each other motivated: self-care has

become a top priority, and this during-the-quarantine

focus on self-care is expected to persist. Most lingerie

stores have stayed active on social networks to

maintain a strong link with their customers, stepping

out of the strict product-marketing, and sharing more

of lifestyle and unrelated-to-undergarments posts and

stories. Where a relationship was purely customerproduct,

it can now transcend to customer-store staff.

Both in the USA and Canada, the great majority of the

stores used a combination of means to maintain the

relationship with their most loyal customers. Instagram

experienced a real surge during the lockdown and is

now as used as much as Facebook, both by 84%. The

stores appreciate Instagram for the simple, yet

impactful, concept: here, little or no text, it is enough

to share a pretty photo or a catchy video that can -

sometimes - lead to a sale, all the while leveraging the

hashtags to allows retailers to reach users locally or,

optionally, over a larger area. In addition to the basics

of posting a picture, boutiques have also gone Live

organizing weekly Facebook or Instagram streams, or

otherwise having customers tune-into Zoom calls.

Nearly half of respondents (46%) were performing

these online collection presentations.

Creative (and Alternative) Thinking

Keeping the thread of the customer picturing themselves in the garments, in that bikini that they can reward themselves with once the quarantine is over, how else could the stores entice their customers to make purchases? More than half (54%) of the respondents expressed that they had promotions, discounts, or special purchase conditions to tempt their clientele a little further, and 41% were giving a pre-order or hold option for customers to collect their treats upon store reopening. Other new sales techniques have also surfaced, and they might be here to stay: virtual bra fitting, although met with some initial resistance, has started finding popularity in the industry. La Pêche Lingerie, for instance, has fully embraced the new strategy, “[w]e are doing virtual bra fitting and have created a beautiful package with our graphic designer to send to those people who are interested. This will be a service that we will continue to offer after the store reopens.” Over half of the stores (55%) have engaged in remote consultations, be it bra fitting, styling, or for garment maintenance. Yet, 40% kept the conversation going with their clientele by picking up the phone. Similarly, 79% have continued to advertise via regular mail. Not to forget the store window itself, still a very effective way for product promotion as Genalisa Lingerie observes: “[t]he shop has a highly visible window for all the locals staying close to home. Many who pass by on their way to grocery or walking their dogs and daily exercise see the window and have contacted me for purchasing.”

How to Seal the Deal?

Now enticed by the Instagram pictures, Facebook

Lives, promotions, and window-shopping, how do

customers make their purchases? Half of the stores

are using their own online shops, while a relatively

small number -12% - is using Facebook Marketplace,

and even less 5% are using eBay or other

marketplaces. Indeed, several stores expressed the

desire to sell via alternative platforms; however,

some of these were unable to so, met with various

difficulties

Most surprisingly, is that 28% of the respondents are

not selling online by any means. One such store

answered the survey in the early days of the

lockdowns and then changed the answer, faced with what was becoming a harsher reality.

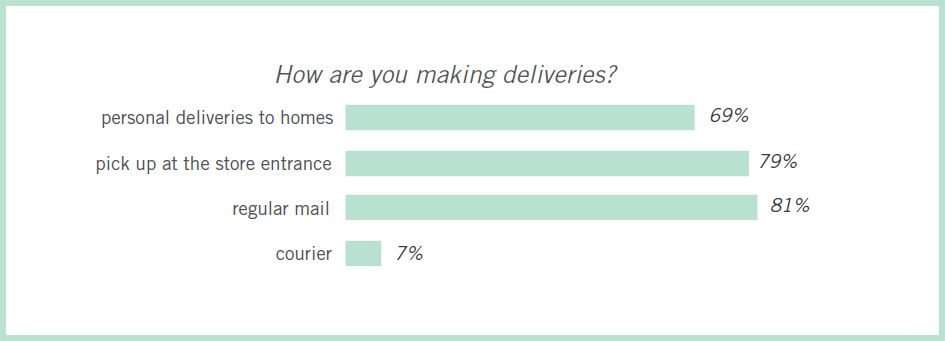

In the initial weeks, they responded that “[w]e don't believe selling online is best for our clients if we have them on file then no problem but new people not sure how to get there right fit and style without seeing them,” after some time to it starting to look like there was no end in sight, the boutique changed its tune, although one can imagine with much reluctance, and revised their answer “[w]e are in the process of getting an online store started.” Perhaps, coming to the realization, that it might be best for a combined approach to sales. As for getting the products into the hands of their clients, the overwhelming majority of stores are providing any combination of regular mail (81%), home delivery (79%), or store pickup options (69%), while only 7% are opting for courier service.

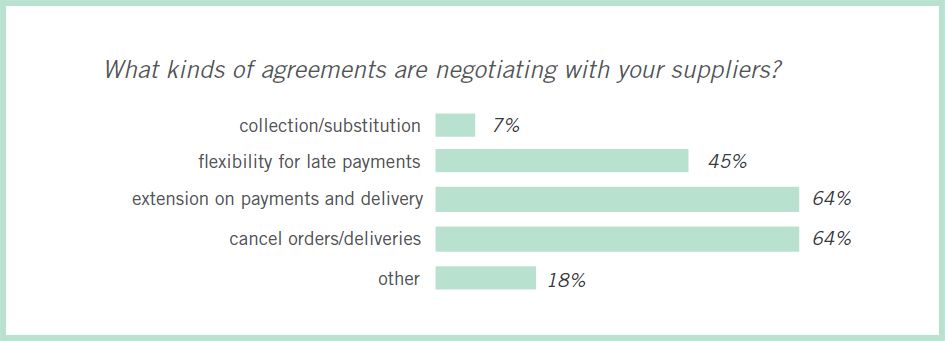

The Brand’s Ear

What about the brands-shop relationship in managing the crisis? The opinions are mixed, the interviewees attesting to very variable situations depending on the brand. Although it is sometimes difficult to find, a common ground seems to have been reached in a majority of the cases – 64% – in terms of order and delivery cancellations as well as/or and an extension on payment and delivery times for the goods already ordered. Many of the stores, 45%, were also afforded flexibility for late payments. To note, not all too surprising, the items that were already shipped and delivered to the boutiques were collected and substituted by the brands in only a negligible number of instances. Happy with the support from their brands, many respondents made note to acknowledge the effort, the general feeling being that of flexibility and cooperation.

part 2 - The Progression

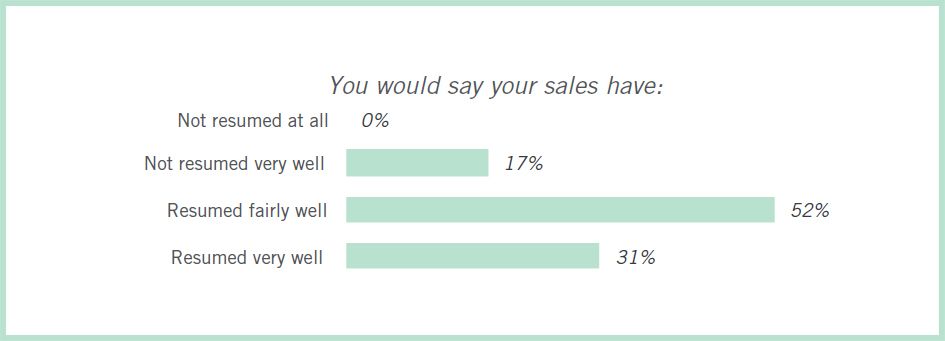

This second part of the survey, originally administered in hopes of widespread reopening, has now been completed as a check-in on the evolving situation, providing an updated insight on the retail climate. As a positive sign, 48% of the stores confirm their activity resumed well - even very well for 31%. In evaluating the responses, it is nevertheless important to consider that some stores that traditionally take part in our survey are still in lockdown and others are too concerned about the situation and prefer not to comment, which makes the results a little more optimistic than they would be.

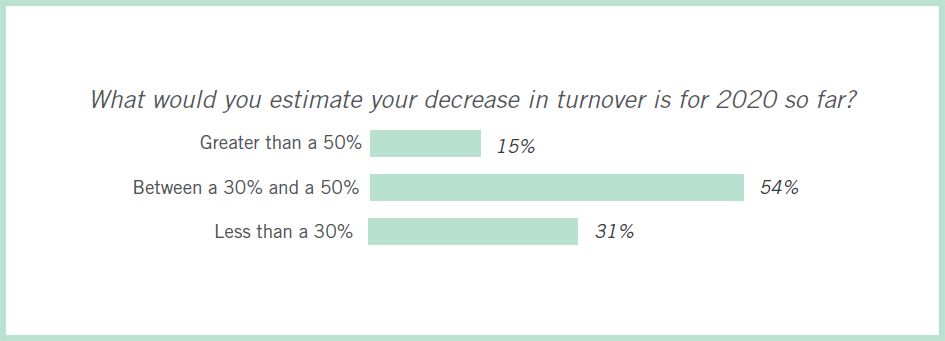

Big Store and City Blues

Both in the USA and Canada, the situation

varies significantly according to each state,

province, or city and its pandemic policy.

Overall, however, the trend shows that the

bigger the store, the stronger the negative

impact. This is most evident in noting the

situation in New York City, where rent can

reach 45,000 USD per month, meaning that a

store must generate 3,000 USD per day just to

stay open!

For instance, a store in the major metropolitan

area of Chicago reported over a 50% decrease

in turnover, confirming our suspicions that “in

major metropolitan cities with high-density

populations like NY and Chicago, restrictions

are tight and it will be rough until post-COVID.”

Sally Ann Corset Shop Inc, also located in

Chicago, commented that their sales have not

resumed very well citing “no weddings, proms,

graduations” as the cause.

One big store, this one in Albany, New York,

reported a 50% decrease in turnover and

commented on the reality that was the

lockdown in their state: “2020 started out really

well with January, February, and early March.

By mid-March, and continuing through June,

sales plummeted like a rock while people stayed

home.”

Another major store, La Lingerie from

Wisconsin announced a 70% drop in sales

over the first two months of lockdown. Since

re-opening, sales were down by 30% and they

predict their overall year will end 25% lower

than last year, “Pretty amazing considering.

We have created a new e-commerce site, a

new blog, new virtual services, streamlining

inventory and looking at growth in a new

way.”

Location Luck

Another phenomenon has also occurred: a - perhaps temporary - customer migration. Stores that opened before others are welcoming new clientele from regions that were still unable to open. Jason Palmer at Petticoat Lane in Greenwich, Connecticut, noted that “Greenwich opened well before NY or NJ, so I had people from all over coming to our town to shop.” The staggered reopening and city-to-city citizen behavioral comparison is notable, and Petticoat Lane has experienced it firsthand, being able to contrast their Greenwich store with their store in New York City: “As amazing as my Greenwich, CT store has been performing, unfortunately, my New York City store has been the opposite as NYC just opened and the city is deserted.” Lace Lingerie of Los Angeles expressed a similar occurrence, being able to juxtapose boutiques from a variety of locations. Reporting that their turnover had decreased by less than 30%, they observed that although many shops are expected to close down due to this incident, they are expecting steady sales for the remaining stores.

The Perky Lady, located in North Carolina, is amongst the 52% of stores that consider their level of sales to be catching up fairly well, on the subject, April Buchanan elaborated: “We now are offering virtual services which gave us some flexibility to adapt to sudden changes due to Covid-19 this year. Launching that service kept us in contact with our clients more and showed a willingness to adapt. We believe that ultimately led to a successful re-opening for our client to come back into the shop.” Yet another shop, Bustin' Out Boutique, explained that in answering the survey they assessed the current circumstances and the bigger picture to evaluate their sales: “It's fair to say that our sales have resumed pretty well only when you look at the broader picture. We are open less than half of what we were previously and limit the number of people in our store strictly. However, all those aspects considered we are doing exactly what we need to do to maintain our business during COVID-19.” As for the commentary from the respondents who gauged that their sales as having resumed very well, their words are uplifting and encouraging. Some are phenomenal, such as at Uplift Intimate Apparel, in Indiana, where they reported that their “sales for June 2020 are nearly the same as June 2019. July 2020 is tracking up 50% over July 2019.” Pamela McKinzie from Anna Bella Fine Lingerie, located in Georgia, explained: “We reopened our doors in May. Sales were off 15% in May however bounced back nicely in June, with a 15% increase over the prior year.” Interestingly, although the survey results showed that the swimwear category is not performing particularly well overall this year, it seems that like most other effects on boutiques – this depends on its location. For instance, a shop located in an area where customers have personal pools reported a less than 30% decrease in turnover and stated that “[s]wimwear has been very strong for me as many customers have pools and have been using them more often.”

United Front

The stores went on to express the appreciation they have for their customers and suppliers, noting that without the thread of support from the beginning of the supply chain to the customer, success would be impossible. Everyone – the store, the community, the customer, the supplier – is making compromises be it big or small, these compassionate behaviors are allowing the stores to stay in business. The stores acknowledged that their success has in part been connected to their clientcare and continued customer engagement. TLC Lingerie of Montana’s Tana Re told us that their efforts to keep customers interested during the lockdown has shown positive results on reopening: “Our customers have been enthusiastic to get into our shop and try new products and stretch out of their comfort zones. Being available to talk to customers during the shutdown has helped us facilitate a closer relationship with our customers and have given us a new boost in the communities we serve by being so accessible. We answer quickly our social media, cell texts, and calls. Even when we are closed, we respond timely.” She went on to say that “[w]e feel our customers have really seen the value of our services that we provide. When the shutdown happened, so many businesses got scared and ignored customers by turning off their phones or didn't answer calls. […] We received many calls, texts, messages with bra and undergarment emergencies.” The community support did not end with the suppliers nor the customers, but extended to other boutiques. Tana Re shared that her store is “very thankful for our boutique sisters that have joined with us to help us with advice, and help us swim through this unprecedented season; as we are just babies in this industry with less than two years’ ownership. We see the light at the end of the tunnel and will continue to offer kindness and love to all we serve!” Similarly, specifically regarding the other stores’ exposure for The Best of Intima Awards, Gena Lisanti shared her joy: “This nomination has been a shining star in the year of such incredible unknowns. To see all the other shops and their great accomplishments on Instagram has been very inspiring. Being happy to be along side them and participant in this selection is gratifying and uplifting at a time we need it most!”

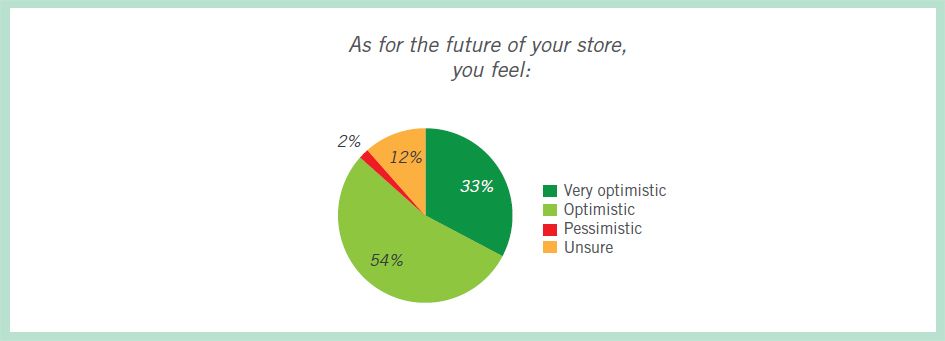

Persistent Positivity

Reporting a less than 30% decrease, Genalisa Lingerie commented that “[a]s we go forward with all good intentions, we are as always, very optimistic. Trying to release orders placed and balance the obvious losses is tricky, however, the show must go on. Core product will always be a safe investment and women will always need a replenish of some form of underpinning or loungewear.” Jackie Keto, from Her Underthings located in Albany, New York shared her bad-newsturned- good, the pandemic acting as the fuel she needed to make a courageous change: “Perhaps I am coming out of this pandemic with a move of my store to a much larger location. On the business side, this scenario has really allowed small businesses to evaluate and see who will and will not help and support them, and make decisions accordingly. I was out of a lease earlier in the year right before the pandemic hit, and with no help from my landlord decided to look elsewhere. Their uncaring I think may have actually been a blessing in disguise, as my new location - opening early August - is twice the size and so much better!” Before we finish off, one last insight from Christina Karakourtis at Tina's Closet’s which has been in business for over 34 years and carries over 100 brands, her advice as simple as it is true: “It’s more about having the essentials and finding and stocking what customers purchase all the time. Basics will always sell.” Tying a bow on the situation as it stands now, we cannot say it better ourselves, we end with the simple, and foundationally true words of Salina Hernandez from The Bra Box … “Our industry is a very special niche and we are needed, either in person, by phone, or online, always!”

Copyright 2024. All right reserved - Terms